ev charger tax credit california

To qualify you must be a site owner or their authorized agent with a Site Verification Form and be a business nonprofit California Native American Tribe or a public or government entity. Note that the federal EV tax credit amount is affected by your tax liability.

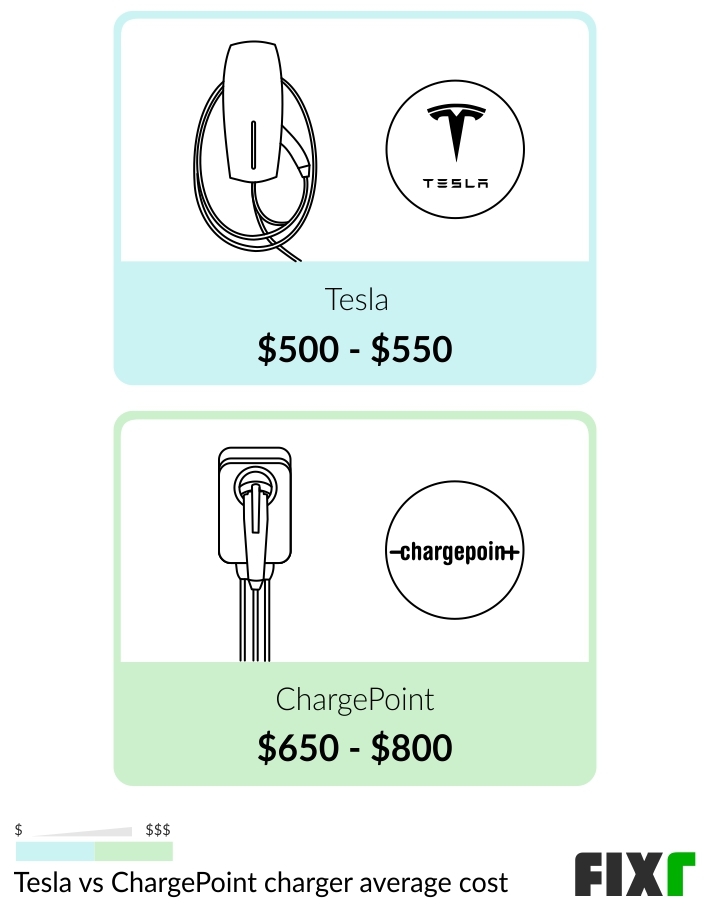

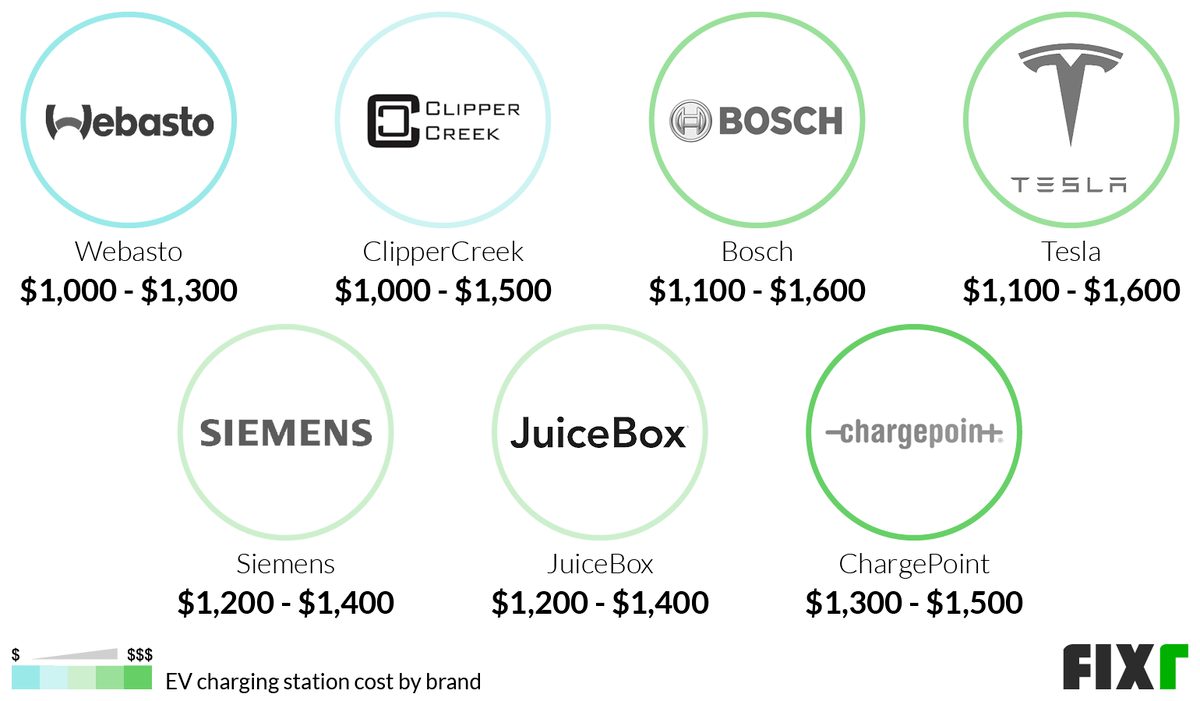

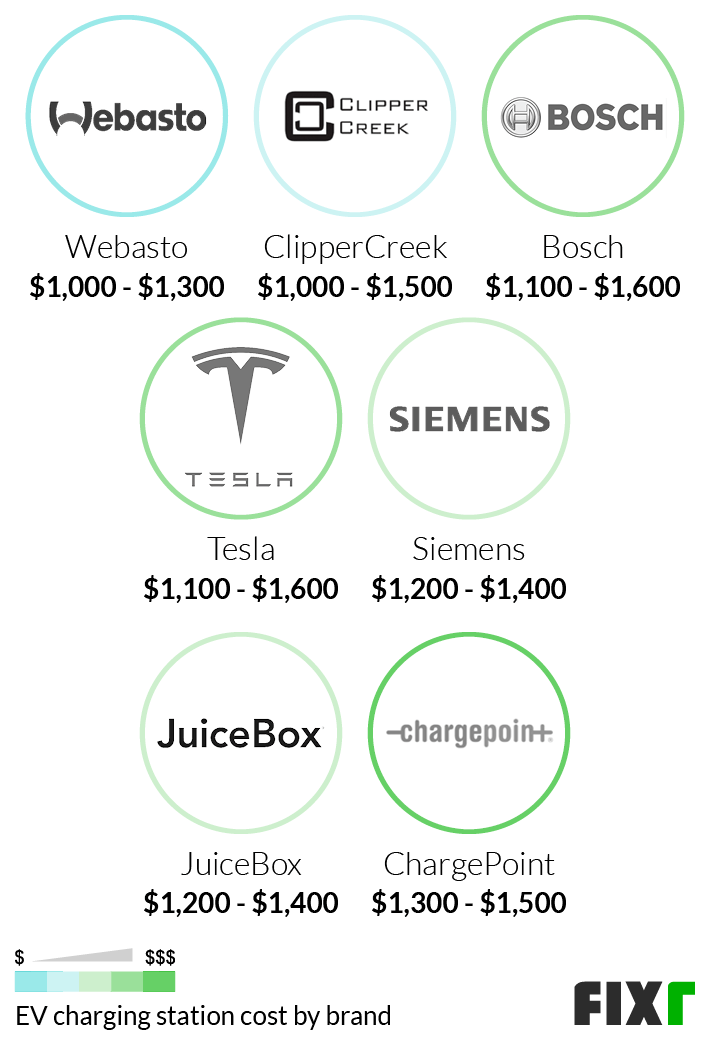

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

The tax credit covers 30 of a companys costs.

. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. California adds 1500 incentive for new EVs total state fed incentives now up to 135K. You can view vehicle tax credits and rebates income-based incentives charging station incentives local utilities electricity discounts and special driving perks for electric vehicles.

Listed incentives may not be available at any given time. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Listed incentives reflect an illustrative estimation of available incentives.

For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker. Incentives are personalized for where you live. The goal of the CalCAP Electric Vehicle Charging Station Program is to expand the number of electric vehicle charging stations installed by small businesses in California.

And its retroactive so you can still apply for installs made as early as 2017. Charging stations software 247 support and parts and labor warranty. More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV vehicles including utility discounts on chargers and electricity rates.

Additional incentives could be available in your ZIP code. Local and Utility Incentives. You may be eligible for a range of incentives including EV rebates EV tax credits and various other benefits.

Electric Vehicle Charging Credit Amended 032521 and 040721 Created Date. That being said California is giving credits to EV owners for an electric car home charger. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. Treasurer Launches Innovative Program to Finance. See a list at DriveClean Electric for All and.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. Treasurer Launches Innovative Program to Finance Electric Vehicle Charging. Electric Vehicle Charging Credit Author.

As an approved vendor across multiple programs and. As of December 2019 California has 22233 electric vehicle charging outlets including 3355 direct current fast chargers at over 5674 public stations throughout the state. Southern California Edisons Pre-Owned EV Rebate Program offers customer a 1000 rebate for the purchase or lease of an eligible used EV.

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Current EV tax credits top out at 7500. Plug-in Electric Vehicle Handbook US.

For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000 credit. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California. Ev charger tax credit california Thursday May 26 2022 Edit.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Avoid the bothersome traffic jams of Los Angeles or Orange County by simply applying to get your HOV sticker.

Electric Vehicle Charging Credit Keywords. The states goal is to have 1500000 zero-emission vehicles on the road and 250000 charging outlets. These rebates help bring down the capital expenditure making installing charging stations a very interesting project for many hotels workplaces or apartment complexes.

View incentives in a specific area by entering a ZIP code below. In this article we will go over ways to save on installing an electric vehicle charger what EV rebate program you might be eligible for and how these. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

This incentive covers 30 of the cost with a maximum credit of. The Central Coast Incentive Project offers rebates of up to 6500 per Level 2 Charger and up to 80000 per DC Fast Charger. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Electric vehicle incentives are listed for all California ZIP codes as well as the top 25. It covers 30 of the costs with a maximum 1000 credit for residents and 30000.

Electric Vehicles Solar and Energy Storage. In some cases these rebates can cover around 70 of total costs. As an approved vendor under many California EV charging incentive programs EV Connect will provide end-to-end solutions such as.

There are many many EV charging station rebates available in California. The program was funded through the California Energy Commission and operated from June 1 2015 through March 31 2022. In California electric vehicle tax credits and incentives are readily available.

Californias Advanced Clean Cars Program CARB. DOE A plug-in electric vehicle handbook that answers basic questions and points readers to additional information to make the best vehicle selection. Rebates And Tax Credits For Electric Vehicle Charging Stations Residential installation can receive a credit of up to 1000.

But Uncle Sam is not the only. That could be worth around 15000. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to you.

Billions Of In Incentives For Ev Charging In 2022 Ev Charging Stations Ev Charging Incentive

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

What Are The Ev Charger Levels

How To Claim An Electric Vehicle Tax Credit Enel X

Beyond Bid Getting Ev Charging Plugged Into Reconciliation Third Way

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

State Electric Vehicle Charging Guide

Track Electricity Use And Cut Costs 100 Remote No Cost No Equipment Sunistics

Rebates And Tax Credits For Electric Vehicle Charging Stations

Bosch Ev200 Series 16 Amp 12 Cord Ev Charging Station El 51245

Powercharge Energy Platinum Level 2 Commercial Ev Charger

Tax Credit For Electric Vehicle Chargers Enel X

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

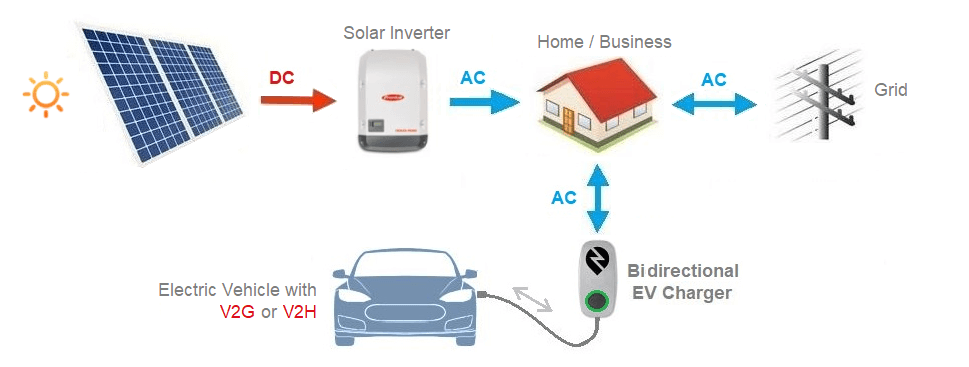

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Delta Ev Charger 30 Amp 25ft Charging Station

Need A Home Ev Charging Station Check Out Your Local Autozone